Increase B2B sales with a single click

Get more time back to spend on your business

Reinvest your time in your goals and let us handle the rest

How Opyn Pay Later Works

A single solution suitable for any channel and sales strategy

B2B buyer visits e-commerce and adds products to cart

Opyn Pay Later performs credit assessment and anti-fraud checks on the buyer

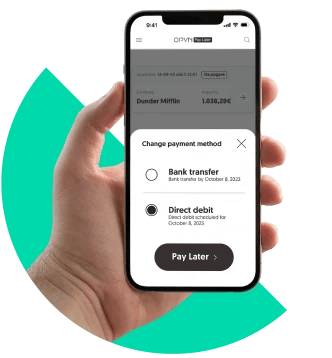

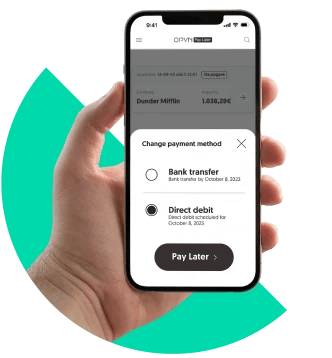

Based on the outcome of the assessment, the buyer chooses the preferred payment option from those available

Opyn Pay Later processes payments based on the number of installments and due dates chosen

The merchant get paid without the need for reminders and according to the plan chosen by the buyer

The merchant creates the payment plan on the platform by entering a few details

Opyn Pay Later performs credit assessment and anti-fraud checks on the buyer

The merchant receives feedback on the assessment in seconds and proceeds to send the payment link

The buyer receives the link and accept the payment with one click

The merchant get paid without the need for reminders

Opyn Pay Later processes payments according to the installment plan accepted by the buyer

An end-to-end solution

Opyn Pay Later supports you throughout the sales process

Credit rating

With our experience in assessing 50,000 companies, we know how to protect our clients from outstanding payments and fraud risk.

Customized payment plans

Our platform provides a number of payment plans:

deferred and installment.

We'll set up the service to reflect your specific needs.

Support and soft collection

We handle late payments and technical support for buyers so you can reinvest your time in your business.